We believe investing is smart because history shows that stock markets go higher in the long term. But if you choose that path, you're going to buy some stocks that fall short of the market. Unfortunately for shareholders, while the DISH Network Corporation (NASDAQ:DISH) share price is up 26% in the last year, that falls short of the market return. However, the longer term returns haven't been so impressive, with the stock up just 21% in the last three years.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for DISH Network

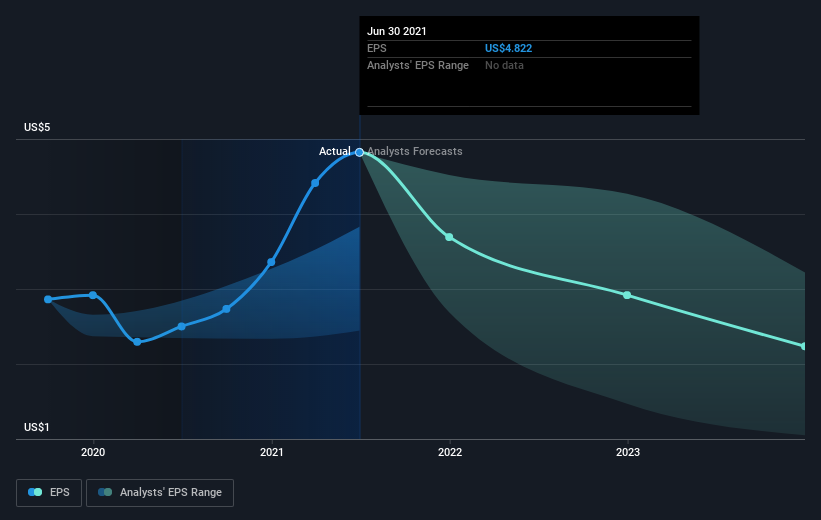

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

DISH Network was able to grow EPS by 93% in the last twelve months. It's fair to say that the share price gain of 26% did not keep pace with the EPS growth. Therefore, it seems the market isn't as excited about DISH Network as it was before. This could be an opportunity. The caution is also evident in the lowish P/E ratio of 9.06.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of DISH Network's earnings, revenue and cash flow.

A Different Perspective

DISH Network shareholders are up 26% for the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 2% endured over half a decade. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand DISH Network better, we need to consider many other factors. Even so, be aware that DISH Network is showing 2 warning signs in our investment analysis , and 1 of those is significant...

But note: DISH Network may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade DISH Network, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

"dish" - Google News

August 26, 2021 at 05:39PM

https://ift.tt/3sSaS5X

Those who invested in DISH Network (NASDAQ:DISH) a year ago are up 26% - Simply Wall St

"dish" - Google News

https://ift.tt/2MXZLF4

No comments:

Post a Comment