This pasta dish made with what could be considered pantry staples turns out an elegant and delicious offering for supper, and needs only a salad to go along with it. Of course, not everyone is going to have pine nuts or canned artichokes on hand, but after tasting this, you might want to stock them. Besides being very easy to prepare, any vegetarian in your midst will welcome the meal.

I learned about this from my friend Cris, sojourning in Italy, when he sent a picture of a plateful that he snapped in a Florence restaurant. Then during a recent visit here, Cris made it for our supper and I watched.

You’ll need artichokes, pine nuts, pasta, olive oil, butter and garlic — that’s it. In Italy, cooks make this with fresh artichokes, which you can grow in Maine, by the way. It might be fun to select small artichokes, usually the side-shoots, cook them and peel away tough leaves until you arrive at the softer bottom. Or you can just open a can.

First, though, make sure that the artichokes you acquire are not in a dressing with oil, vinegar and herbs. Plain canned ones, about five or six artichoke bottoms in a 14-or-so-ounce can is the ticket. The nutrition information might say that the can consists of one serving, but not in this recipe.

You’ll need pignoli — pine nuts — the very same favored for basil pesto. Sure, they’re a bit pricey but the recipe uses only a few so live a little and get some to keep around.

You can use just about any pasta you like. We had it on bucatini. When I saw the amount of sauce prepared I thought it looked a little skimpy but I’m here to tell you that it spreads itself around pretty generously, so don’t worry about having enough. Puree the artichokes, add the result to minced garlic cooked in some olive oil, and add only a very little cream or half-and-half, or some of the pasta cooking water if it looks a little dry. Toss it with the cooked pasta to spread the flavor all over each strand of pasta. Delicious.

Don’t add parmesan. Not only does the dish not need it, parmesan is strictly not traditional, and you wouldn’t want to mess with tradition, would you?

Cream of Artichokes and Pine Nuts on Pasta

Makes three or four servings.

Salted water for cooking pasta

Olive oil

8-12 ounces of pasta

1 garlic clove, finely minced

1 14-ounce can or five to six artichoke bottoms, chopped.

2-3 tablespoons of cream, half-and-half or pasta cooking water

¼ cup pine nuts

Put well-salted water on to boil to cook the pasta. Add pasta when the water is boiling vigorously.

Meanwhile, put enough oil in a heavy saucepan to just cover the bottom and heat it to a simmer.

Add the garlic and cook very briefly to soften it then stir in the artichokes to heat them.

Puree the artichokes and garlic together. If the mixture looks dry, add cream or pasta cooking water.

Toast the pine nuts briefly to a golden color, stirring to keep them from burning. Set aside.

Drain the pasta when it is ready and put back into the pot, add the artichoke cream and toasted pine nuts. Toss together with tongs until the pasta is well coated.

Serve.

"dish" - Google News

March 01, 2022 at 06:40AM

https://ift.tt/gesp83W

Clear out your pantry with this authentic pasta dish - Bangor Daily News

"dish" - Google News

https://ift.tt/8iSQMNg

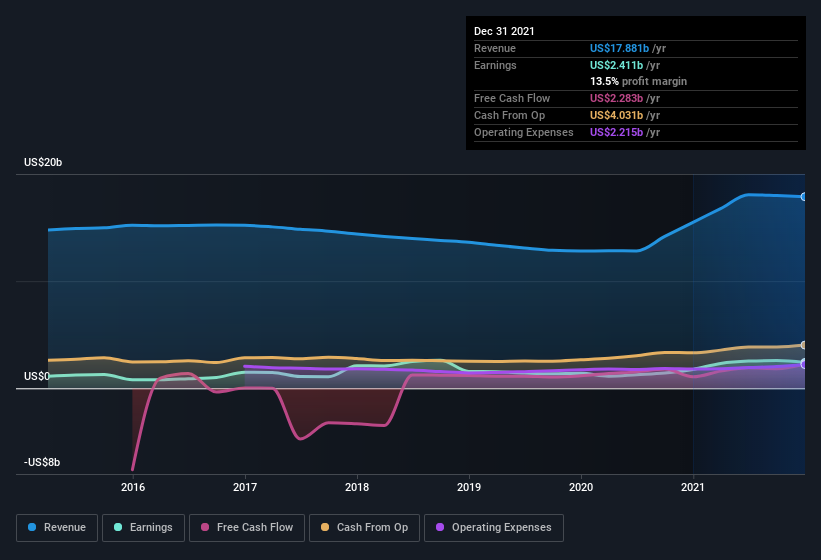

- Zacks

- Zacks