Broadly speaking, profitable businesses are less risky than unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it’s not always clear whether statutory profits are a good guide, going forward. Today we’ll focus on whether this year’s statutory profits are a good guide to understanding DISH Network (NASDAQ:DISH).

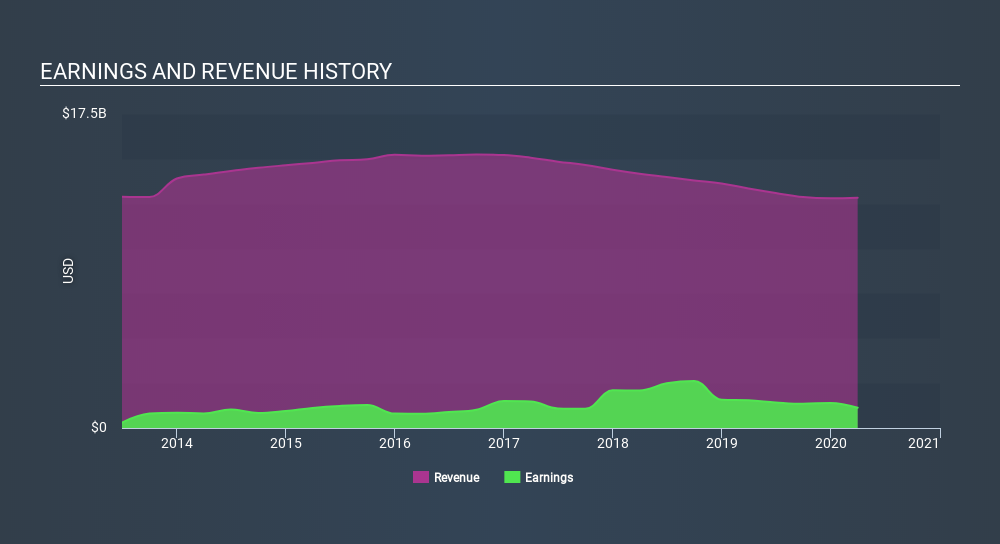

We like the fact that DISH Network made a profit of US$1.13b on its revenue of US$12.8b, in the last year. The chart below shows that both revenue and profit have declined over the last three years.

See our latest analysis for DISH Network

Not all profits are equal, and we can learn more about the nature of a company’s past profitability by diving deeper into the financial statements. Therefore, today we will consider the nature of DISH Network’s statutory earnings with reference to its dilution of shareholders and the impact of unusual items. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, DISH Network issued 12% more new shares over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of DISH Network’s EPS by clicking here.

A Look At The Impact Of DISH Network’s Dilution on Its Earnings Per Share (EPS).

DISH Network’s net profit dropped by 23% per year over the last three years. And even focusing only on the last twelve months, we see profit is down 27%. Sadly, earnings per share fell further, down a full 31% in that time. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

If DISH Network’s EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company’s share price might grow.

How Do Unusual Items Influence Profit?

Alongside that dilution, it’s also important to note that DISH Network’s profit suffered from unusual items, which reduced profit by US$355m in the last twelve months. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that’s hardly a surprise given these line items are considered unusual. If DISH Network doesn’t see those unusual expenses repeat, then all else being equal we’d expect its profit to increase over the coming year.

Our Take On DISH Network’s Profit Performance

To sum it all up, DISH Network took a hit from unusual items which pushed its profit down; without that, it would have made more money. But unfortunately the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). That will weigh on earnings per share, even if it is not reflected in net income. Given the contrasting considerations, we don’t have a strong view as to whether DISH Network’s profits are an apt reflection of its underlying potential for profit. With this in mind, we wouldn’t consider investing in a stock unless we had a thorough understanding of the risks. Every company has risks, and we’ve spotted 4 warning signs for DISH Network (of which 1 is a bit concerning!) you should know about.

Our examination of DISH Network has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to ‘follow the money’ and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

"dish" - Google News

June 02, 2020 at 06:48PM

https://ift.tt/3eIzeXC

Should You Use DISH Network’s (NASDAQ:DISH) Statutory Earnings To Analyse It? - Simply Wall St

"dish" - Google News

https://ift.tt/2MXZLF4

No comments:

Post a Comment